We’re not exactly great at cybersecurity, but we’re top of the class when it comes to spyware!

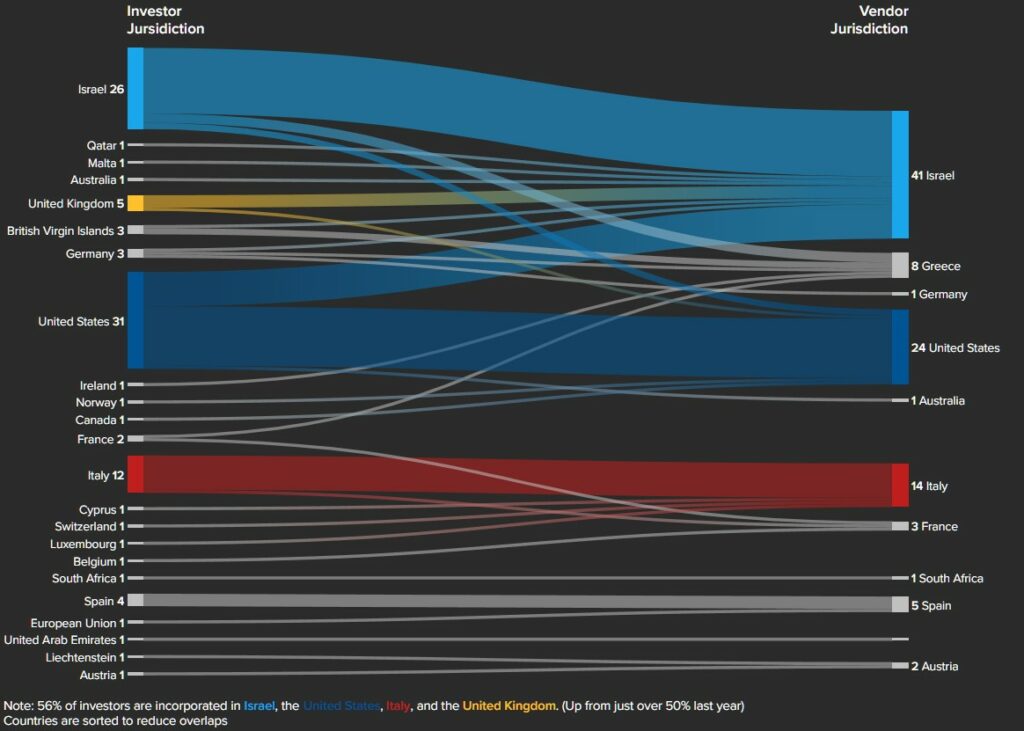

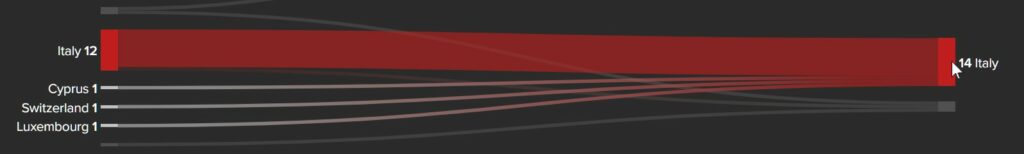

According to an Atlantic Council study, the spyware industry is booming as investors increasingly turn their attention to this ethically questionable yet highly profitable sector. Most of the money goes to companies in the United States and Israel, but Italy comes in third.

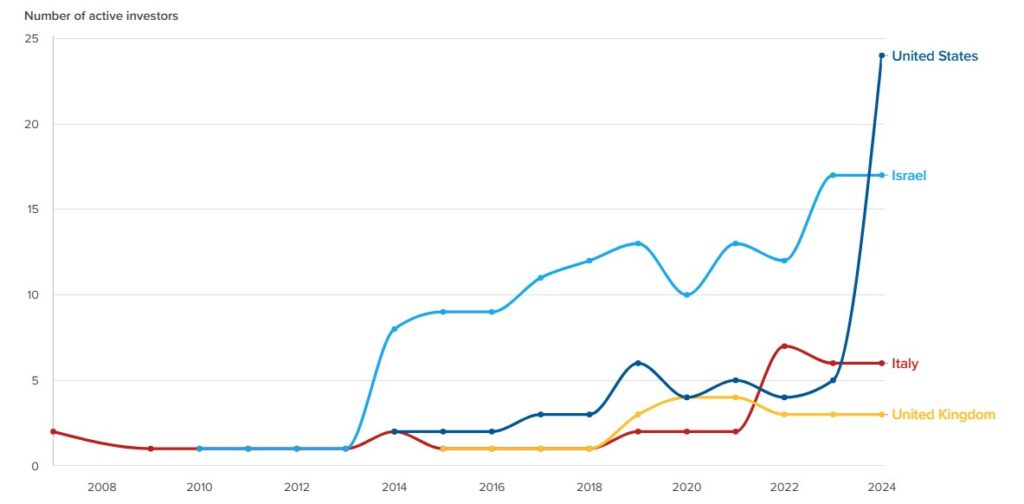

And American investments in spyware have tripled in the last year.

The Atlantic Council study examined 561 organizations from 46 countries from 1992 to 2024. In doing so, the experts managed to identify 34 new investors, bringing their total number to 128 (compared to 94 in 2024).

It is noticeable that the greatest interest in spyware is shown by American investors: in 2024, 20 new investing firms were identified in the United States, bringing the total to 31. This growth far outpaced that of other countries, including Israel, Italy, and the United Kingdom.

Therefore, the number of investors identified in the EU and Switzerland was 31, with Italy, considered a key spyware hub, accounting for the largest share with 12 investors. The number of investors in Israel was 26.

Among the American investors, Atlantic Council analysts include major hedge funds DE Shaw & Co. and Millennium Management, the well-known trading firm Jane Street, and the major financial firm Ameriprise Financial.

According to the report, all of them sent funds to the Israeli legal spyware vendor Cognyte. It should be noted that this companyhas previously been linked to human rights abuses in Azerbaijan, Indonesia and other countries.

Another notable example of American investments in spyware is the recent acquisition of the well-known Israeli spyware vendor Paragon Solutions by AE Industrial Partners, a Florida-based private equity firm specializing in national security.

The report’s authors emphasize that while American policymakers have systematically combated the spread and abuse of spyware, sometimes with harsh policy measures, there is a significant disconnect between them and US investors, because “US dollars continue to fund the very entities that US policymakers are trying to fight.”

One example cited is the spyware vendor Saito Tech (formerly Candiru), which has been on the U.S. Department of Commerce’s sanctions list since 2021 and received new investment from the U.S. firm Integrity Partners in 2024.

In addition to focusing on investments, the Atlantic Council writes that the global spyware market is “growing and evolving,” and now includes four new vendors, seven new resellers or brokers, 10 new service providers, and 55 new individuals associated with the industry.

For example, recently identified vendors include Israel’s Bindecy and Italy’s SIO. Resellers include front companies associated with NSO Group’s products (such as Panama’s KBH and Mexico’s Comercializadora de Soluciones Integrales Mecale). New service providers include the British Coretech Security and the US ZeroZenX.

The report highlights the central role played by these resellers and brokers, who represent an “understudied group of actors.”

“These organizations act as intermediaries, obscuring the connections between sellers, suppliers, and buyers. Often, intermediaries connect suppliers with new regional markets. This creates a complex and opaque supply chain for spyware, making it extremely difficult to understand corporate structures, jurisdictional manipulations and liability,” the study’s authors told Wired.

Follow us on Google News to receive daily updates on cybersecurity. Contact us if you would like to report news, insights or content for publication.