Artificial intelligence has been the biggest trend in recent years, as the stock prices of AI-related tech giants have skyrocketed. NVIDIA has surpassed the $5 trillion market cap, becoming a bellwether for the AI bull market in the United States and even globally.

However, the debate over whether AI is a bubble has continued and intensified over the past week, with its effects starting to be felt.

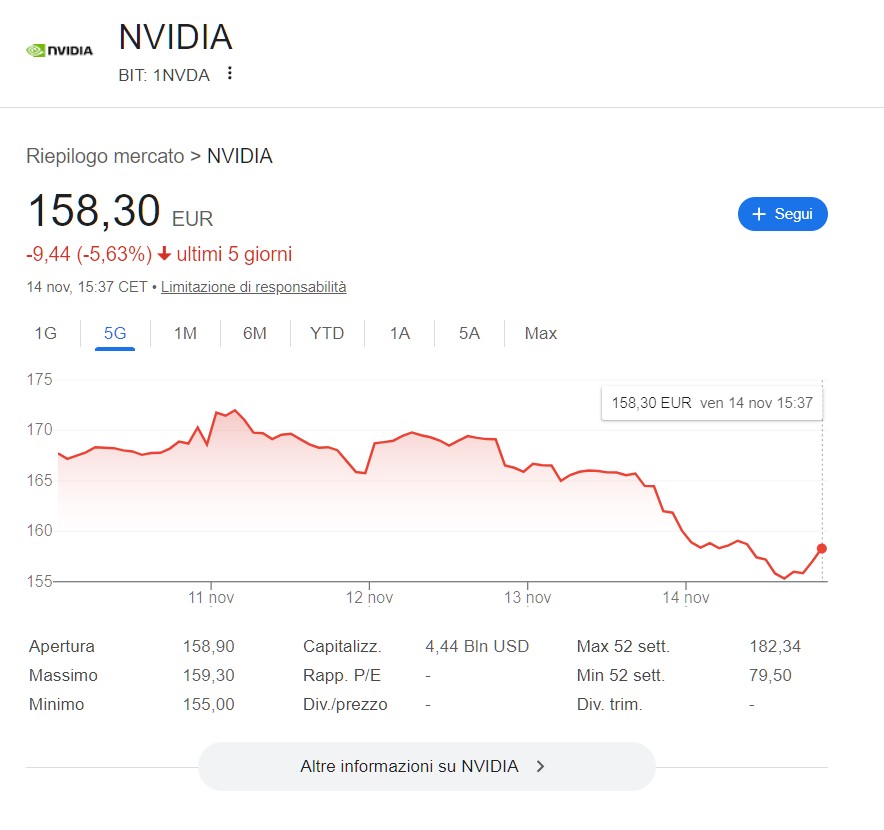

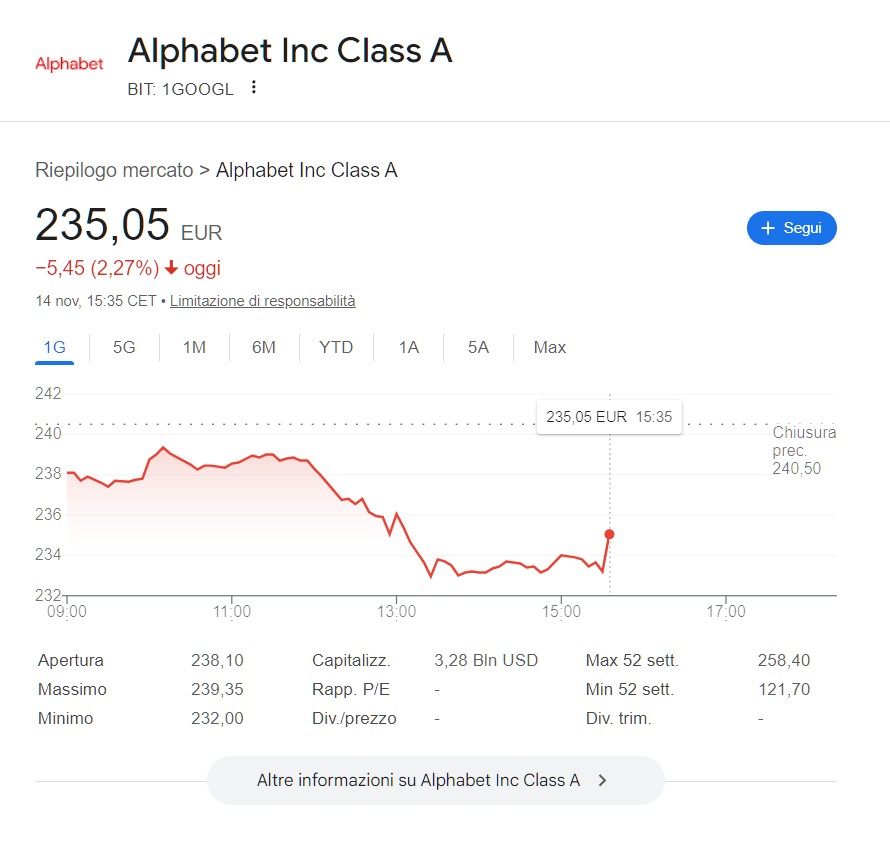

NVIDIA’s stock price has fallen for several consecutive days. Not only has NVIDIA suffered a decline, but other tech giants have also fallen: Google has fallen along with Broadcom and Tesla.

The past few days have seen a bloodbath among US tech giants, particularly AI-based memory chip giants, with SanDisk down 16% and Seagate and Western Digital down more than 10% in two days.

Related funds were also the first to sense the shift. Masayoshi Son’s SoftBank Group had already sold all its NVIDIA shares by the end of October, realizing a profit of $5.8 billion.

Bridgewater Associates, the world’s largest hedge fund, also significantly reduced its holdings in NVIDIA by the end of September, holding only 2.51 million shares, a sharp decline of 65.3% from 7.23 million shares at the end of the second quarter. In contrast, Bridgewater had just increased its holdings in NVIDIA by 150% in the second quarter.

The artificial intelligence market, which has been booming for three years, is experiencing a clear cooling, as major short sellers in the United States have recently started dumping NVIDIA shares.

The market is currently waiting for what seems like an eternity: NVIDIA’s third-quarter earnings report, due out on the 19th.

If results continue to improve, AI will likely lead the stock market recovery. However, if performance falls short of expectations , AI will obviously need some tweaking.

Follow us on Google News to receive daily updates on cybersecurity. Contact us if you would like to report news, insights or content for publication.