In recent years, the topic of rare earths has returned to the forefront of international debate, especially given China’s dominant role in this strategic sector. Many wonder: why does the United States need to purchase rare earths from China, despite possessing significant reserves?

US government data from 2022 sheds some light on some issues. China holds 44 million tons of rare earth reserves, equal to 33.8% of global reserves, but produces 69.2% of the global total.

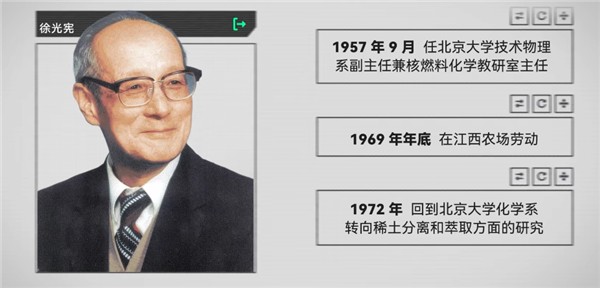

China’s advantage is not limited to ore quantities, but is based on decades of technological development and the complete integration of the industrial chain. As early as 1972, chemist Xu Guangxian developed the theory of cascade mining , which was successfully applied on an industrial scale in 1974 at the Baotou steel mill.

This revolutionary method allowed China to surpass US production in 1986 and to control two-thirds of global production by the 1990s, prompting many international producers to withdraw from the market.

From 2014 to 2023, six major companies were integrated into two major groups— China Rare Earth and Northern Rare Earth — creating a complete supply chain for light, medium and heavy rare earths, with a 92% production capacity for permanent magnets, 6N (99.9999) purity of heavy rare earths, 85% utilization of solid waste, and emission reduction of more than 60%.

The elements defined as “rare earths” include 15 lanthanides: anthanum (La), cerium (Ce), praseodymium (Pr), neodymium (Nd), promethium (Pm), samarium (Sm), europium (Eu), gadolinium (Gd), terbium (Tb), dysprosium (Dy), holmium (Ho), erbium (Er), thulium (Tm), ytterbium (Yb), and lutetium (Lu), plus scandium and yttrium, for a total of 17 elements.

They are not rare in the absolute sense: they are more abundant in the Earth’s crust than copper and over 90,000 times more abundant than gold. However, the difficulty of separating and purifying them makes them difficult to exploit industrially.

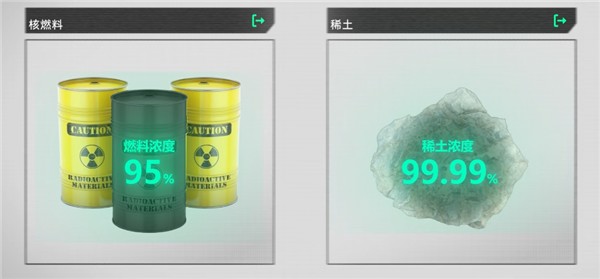

Rare earths are classified into light and heavy, but the classification is not based on atomic weight but rather on their chemical and mineral behavior. China is currently the only country in the world capable of producing heavy rare earths with a purity of 6N, while other countries do not exceed 4N (99.99%).

In the 1960s and 1970s, the United States, thanks to Molycorp Mining Corporation , dominated world production of rare earths.

However, mining involved thorium contamination. In 1980, the Nuclear Regulatory Commission (NRC), following the guidance of the International Atomic Energy Agency, imposed stringent regulations, increasing costs and causing the industry to shrink.

The Yamaguchi mine closed in 1998, and for years the U.S. lost commercial purification capacity, only regaining attention in 2002.

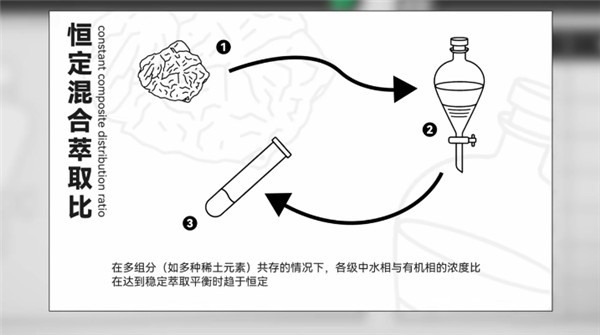

China surpassed foreign expertise with innovations such as Xu Guangxian’s cascade mining, based on the concept of “constant mixed extraction ratio.” This methodology transformed a slow, costly, and empirical process into a theoretical and mathematical system applicable on a large industrial scale as early as 1974.

In the decades that followed, techniques such as “three-output,” “one-step amplification,” and “grafting” cemented China’s technological lead.

By 1986, Chinese production had surpassed that of the United States, and by the 1990s it accounted for more than two-thirds of the world market, leading to sharp drops in global prices and the closure of many foreign companies.

Since 2014, China has consolidated hundreds of companies into a few major groups, creating a comprehensive industrial ecosystem. This has made possible:

Abroad, plants like Lynas in Malaysia have only recently achieved comparable levels of heavy rare earth purification, while the US, despite investing nearly $1 billion in its Yamaguchi mine, is not yet capable of processing heavy rare earths on an industrial scale.

China’s dominant position in the global rare earth market stems not solely from reserves, but from a complex mix of technological innovation, industrial integration, and advanced environmental management.

Since 2000, the country has produced over 85% of the world’s minerals and over 95% of smelting and separation products. Patents and new technologies continue to consolidate this advantage, making it difficult for other countries to replicate the entire industrial supply chain.

Follow us on Google News to receive daily updates on cybersecurity. Contact us if you would like to report news, insights or content for publication.